Is landlord boiler cover worth it?

Should you buy landlord cover?

Being a landlord comes with a lot of responsibility. Among these is ensuring the comfort and safety of tenants by making sure essential amenities such as heating and hot water are always in working order. That said, boiler breakdowns are not only inconvenient but can also cost a considerable amount of money to fix. One way to mitigate against such unforeseen costs is to have boiler cover. Still, the question lingers, is landlord boiler cover worth it?

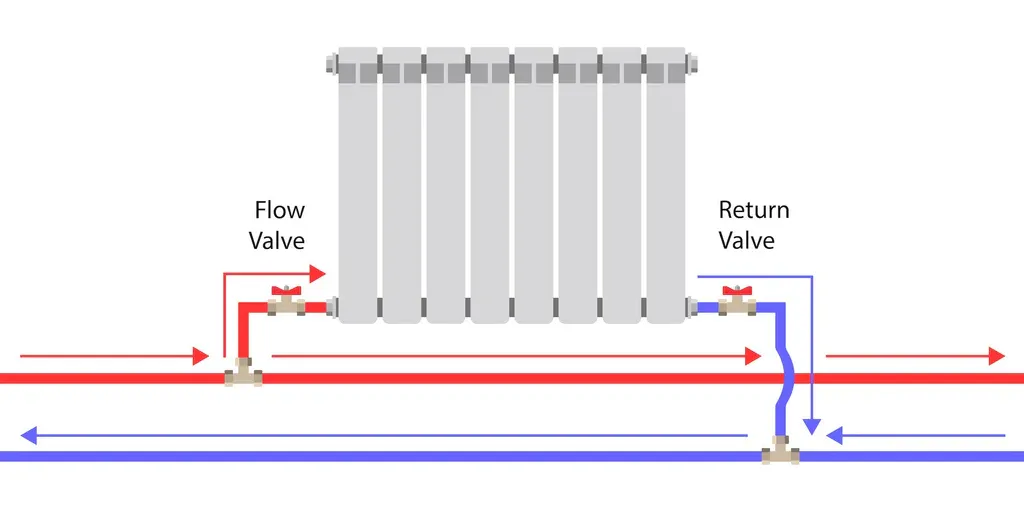

Boiler cover is essentially a type of insurance policy for your boiler. It covers the cost of engineer call-outs, labour, and replacement parts in the event of a breakdown. Some policies also include annual boiler servicing, helping to keep the boiler in good condition and working smoothly. For landlords, there is a specific type of boiler cover known as landlord boiler cover. This boiler cover not only includes emergency repairs but may also include an annual gas safety check, a crucial requirement for all rented properties in the UK.

On one hand, boiler cover offers peace of mind that if anything goes wrong, the repair won’t result in a large, unforeseen expense. This can be particularly beneficial if the boiler is older and potentially more prone to faults and breakdowns. A boiler cover policy often consists of a monthly or annual premium, which can provide a simple way to budget for boiler maintenance and unexpected boiler issues. It also usually includes access to a helpline to arrange repairs, saving valuable time in locating and booking suitable Gas-safe engineers.

Effective landlord boiler cover helps ensure that maintenance or unforeseen repairs do not interfere with the comfortable living conditions of tenants. It poses a sense of responsibility and due care on the part of the landlord, fostering trust between landlords and tenants.

The other side of the debate is in considering the cost of the boiler cover against the age, condition, and reliability of the boiler. If the boiler is relatively new and under warranty, you may feel boiler cover to be an unnecessary expense—in this case, it’s essential to weigh the cost of the premium against the likelihood of a problem occurring.

Although most modern boilers are reliable, they are mechanical devices and not immune to malfunctioning. The cost of one-off repairs can quickly mount up, often surpassing the cost of a boiler cover policy. According to the consumer group, Which?, the average cost of a one-off boiler repair is around £210 - a sum that could cover a year's boiler service and maintenance policy.

Another aspect to consider is the convenience provided by boiler cover. Typically, such a policy provides 24/7 emergency call outs. For landlords with multiple properties or those who live far from their rental properties, time is a crucial factor. The ability to have a faulty boiler quickly fixed without the need for the landlord's presence can be of immense value.

A deciding factor is the landlord’s legal obligation to provide a safe environment for their tenants. The UK law stipulates that landlords are responsible for repairs to heating, hot water installations, and sanitation facilities. Hence, opting for boiler cover ensures landlords meet this obligation without delay, therefore reducing the risk of breaching rental contract conditions.

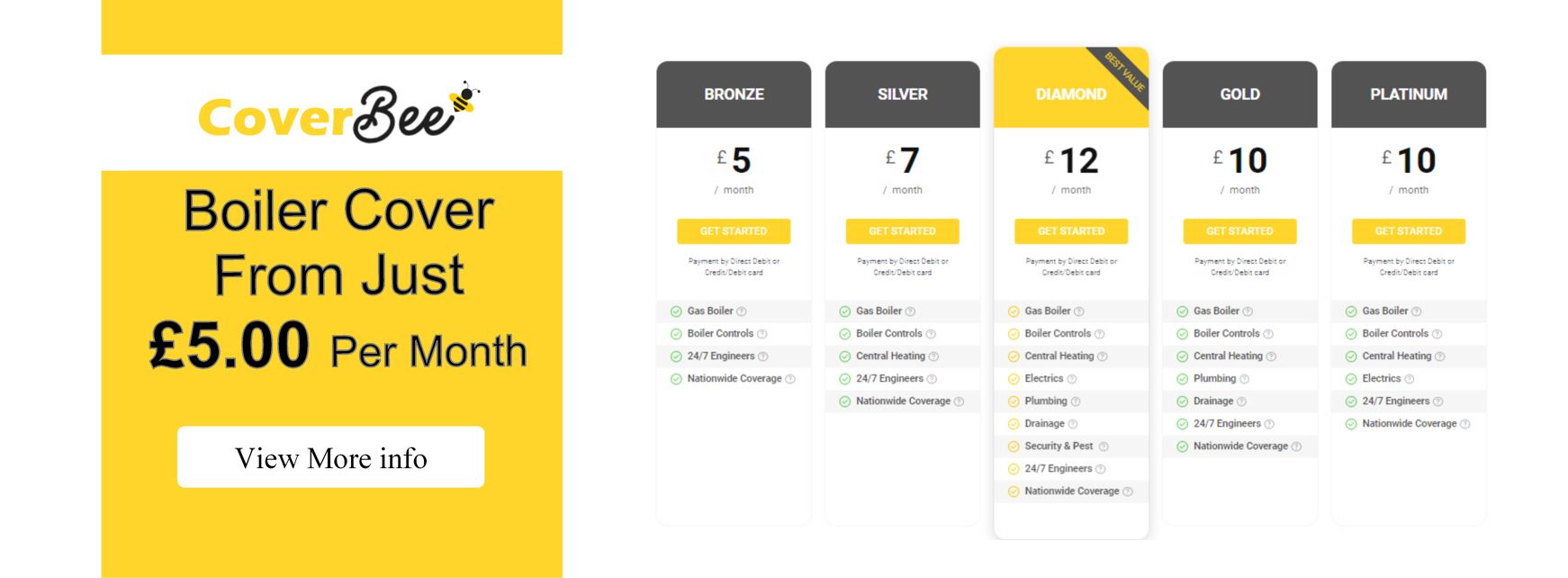

However, not all boiler cover is the same. When choosing cover, landlords should consider how comprehensive the policies are. Some merely cover the boiler, while others extend the cover to include the entire heating system. Some policies include an annual boiler service, while others don't. Prices also vary depending on the excess, the level of cover, the age and model of the boiler, and even the property location.

In conclusion, whether landlord boiler cover is worth it or not largely depends on individual circumstances. It's a solution that offers convenience, peace of mind, and financial protection against unexpected boiler problems. Beacon of comfort and a testament to responsible rental management, boiler cover reassures tenants about their living conditions' safety and quality. Especially for landlords with multiple properties or older boilers in their properties, the coverage is more likely to be a good investment. However, it's crucial to read the policy details carefully, assess boiler condition, consider appliance age and any existing warranty protection before making an informed decision. Ultimately, landlords must align their choice not just with cost-saving concerns, but also with their commitment to providing a safe and comfortable living space for their tenants.

Bumble Group Limited

The Unicorn

Main Street

Carlton

WF3 3RW

Company reg 14984774

© 2022 Bumble Group Limited

CONTACT US

0330 533 0340

Customer.services@coverbee.co.uk

CoverBee boiler plans are a home emergency service contract and not a form of insurance.

Repair requests

To prevent works on existing issues present before the plan was taken out, you will be unable to request a repair within the 1st 14 days on all our plans.

If you require a repair within the 1st 14 days of you plan start date, you can still contact us,

we will then supply you with a quotation for one of our approved engineers to carry out a one off repair.

After you have purchased your plan, we may contact you to arrange for one of our approved engineers to carry out your boiler health check. Our engineer will inspect your boiler and heating system (if included) to ensure it is working safely and confirm it meets the requirements of contract. If you report a problem with your boiler or heating before the health check has been carried out, we will still send an engineer, but your boiler must pass the boiler health check before the repair will be carried out under this plan.